The Single Strategy To Use For Affordable Bankruptcy Lawyer Tulsa

Table of ContentsSome Known Details About Chapter 7 Bankruptcy Attorney Tulsa Rumored Buzz on Bankruptcy Lawyer TulsaChapter 7 - Bankruptcy Basics for BeginnersNot known Facts About Tulsa Bankruptcy LawyerThe Definitive Guide to Chapter 13 Bankruptcy Lawyer Tulsa

The stats for the various other major type, Chapter 13, are even worse for pro se filers. (We break down the distinctions between both key ins deepness below.) Suffice it to state, talk to a legal representative or more near you who's experienced with bankruptcy law. Right here are a few sources to find them: It's reasonable that you may be reluctant to spend for a lawyer when you're currently under significant monetary pressure.Many lawyers also offer totally free appointments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is indeed the right choice for your scenario and whether they assume you'll qualify.

Advertisement Now that you've determined bankruptcy is undoubtedly the ideal program of activity and you with any luck cleared it with an attorney you'll need to get started on the documentation. Before you dive into all the main bankruptcy kinds, you should get your own papers in order.

The smart Trick of Tulsa Bankruptcy Consultation That Nobody is Talking About

Later on down the line, you'll in fact need to verify that by revealing all kind of details regarding your financial affairs. Right here's a basic list of what you'll need when traveling ahead: Recognizing papers like your driver's certificate and Social Safety card Income tax return (approximately the previous four years) Evidence of earnings (pay stubs, W-2s, self-employed earnings, income from properties as well as any income from government advantages) Bank statements and/or pension declarations Proof of worth of your possessions, such as vehicle and property appraisal.

You'll wish to recognize what type of financial debt you're trying to fix. Debts like kid support, spousal support and specific tax debts can't be discharged (and insolvency can not halt wage garnishment pertaining to those debts). Pupil finance debt, on the various other hand, is possible to release, but keep in mind that it is difficult to do so (bankruptcy attorney Tulsa).

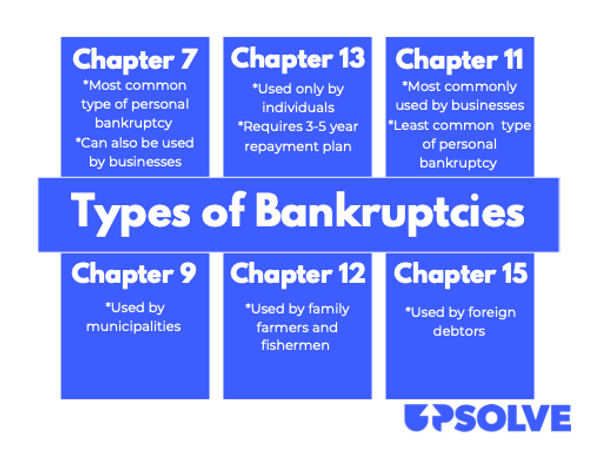

You'll wish to recognize what type of financial debt you're trying to fix. Debts like kid support, spousal support and specific tax debts can't be discharged (and insolvency can not halt wage garnishment pertaining to those debts). Pupil finance debt, on the various other hand, is possible to release, but keep in mind that it is difficult to do so (bankruptcy attorney Tulsa).If your income is as well high, you have another alternative: Phase 13. This option takes longer to resolve your financial obligations due to the fact that it requires a long-lasting settlement plan typically three to 5 years before some of your continuing to be financial obligations are wiped away. The filing procedure is also a whole lot much more complicated than Chapter 7.

A Biased View of Which Type Of Bankruptcy Should You File

A Chapter 7 bankruptcy stays on your credit scores record for 10 years, whereas a Chapter 13 insolvency drops off after 7. Before you send your bankruptcy types, you should initially finish a necessary training course from a credit rating therapy our website firm that has been authorized by the Division of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, face to face or over the phone. Training courses typically set you back between $15 and $50. You have to complete the training course within 180 days of declare insolvency (bankruptcy lawyer Tulsa). Make use of the Department of Justice's site to discover a program. If you live in Alabama or North Carolina, you need to choose and finish a program from a listing of separately accepted service providers in your state.

The Single Strategy To Use For Affordable Bankruptcy Lawyer Tulsa

A lawyer will usually manage this for you. If you're submitting on your very own, understand that there are about 90 different insolvency districts. Check that you're submitting with the right one based upon where you live. If your permanent house has actually moved within 180 days of loading, you must submit in the district where you lived the higher section of that 180-day duration.

You will require to provide a timely listing of what qualifies as an exemption. Exemptions may use to non-luxury, primary automobiles; required home products; and home equity (though these exceptions policies can vary commonly by state). Any kind of building outside the listing of exemptions is thought about nonexempt, and if you don't supply any type of list, after that all your building is thought about nonexempt, i.e.

You will require to provide a timely listing of what qualifies as an exemption. Exemptions may use to non-luxury, primary automobiles; required home products; and home equity (though these exceptions policies can vary commonly by state). Any kind of building outside the listing of exemptions is thought about nonexempt, and if you don't supply any type of list, after that all your building is thought about nonexempt, i.e.The trustee would not offer your sporting activities automobile to instantly pay off the financial institution. Instead, you would pay your lenders that amount over the course of your layaway plan. An usual misunderstanding with insolvency is that as soon as you file, you can stop paying your debts. While bankruptcy can help you eliminate a number of your unsafe financial obligations, such as past due medical costs or individual lendings, you'll intend to maintain paying your regular monthly settlements for safe debts if you want to maintain the building.

The Basic Principles Of Chapter 7 Bankruptcy Attorney Tulsa

If you're at danger of repossession and have actually exhausted all other financial-relief options, then submitting for Chapter 13 may postpone the foreclosure and assist in saving your home. Eventually, you will still require the income to proceed making future home mortgage settlements, in addition to paying off any type of late settlements throughout your settlement strategy.

If so, you might be called for to supply added info. The audit can delay any type of financial obligation alleviation by numerous weeks. Of training course, if the audit turns up wrong info, your case can be dismissed. All that said, these are fairly unusual circumstances. That you made it Get the facts this much while doing so is a good sign at the very least several of your debts are eligible for discharge.

Comments on “Tulsa Debt Relief Attorney for Dummies”